A disaggregated credit model of mortgage rates: forecasting the price of Canadian real estate loans

Mainstream analysts usually say that interest rates on mortgages and home prices are inversely correlated. When interest rates fall, home prices rise. This relationship has little evidence behind it, unfortunately. So, we took a hard look at how things actually work and found that interest rates on mortgages actually lag mortgage credit growth (and, by extension, home price growth) by about 12 months. Causality is reversed in the sense that credit growth drives credit costs (interest rates). This makes much more sense and allows us to forecast rates on mortgages.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

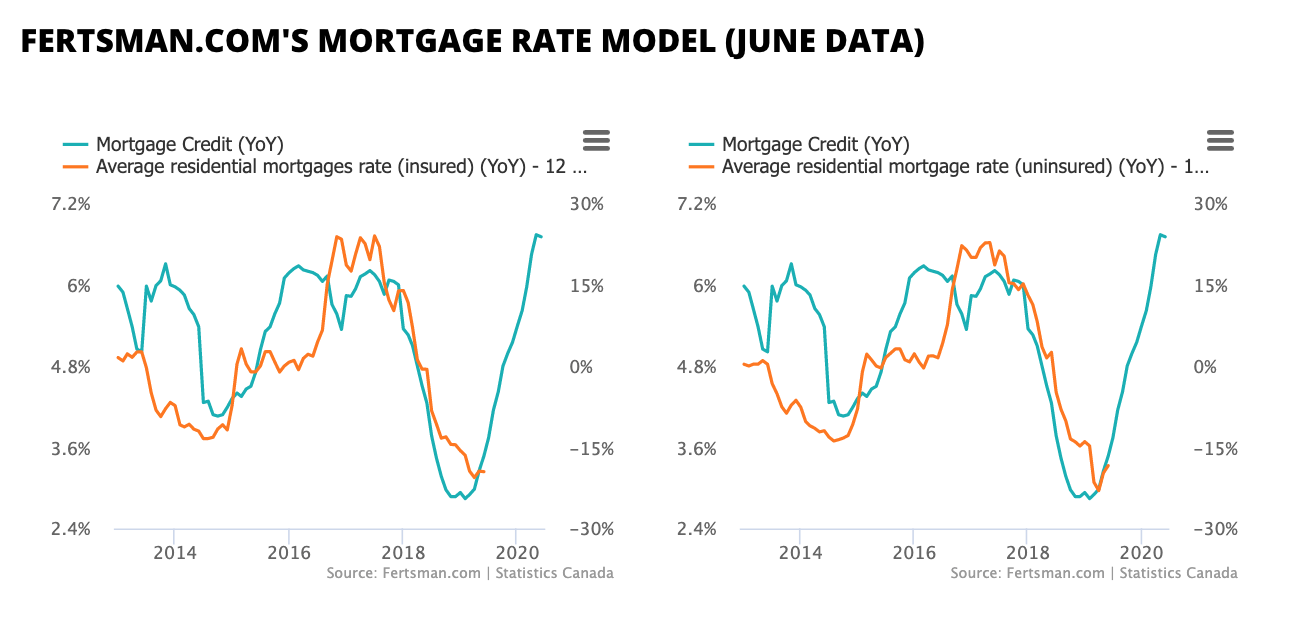

As you can see on the charts above, the statistics for average mortgage rate growth (for both insured and uninsured markets) and mortgage credit growth have a positive relationship when the former is lagged (if you don't lag it then there is no obvious relationship). The statistical correlation can be validated by what actually goes on in the real estate/mortgage world. Mortgage issuers tend to raise rates when there's a huge influx of demand. The cost of credit is like anything else that is at least somewhat rationed: when demand is high and folks pay, prices can be raised.

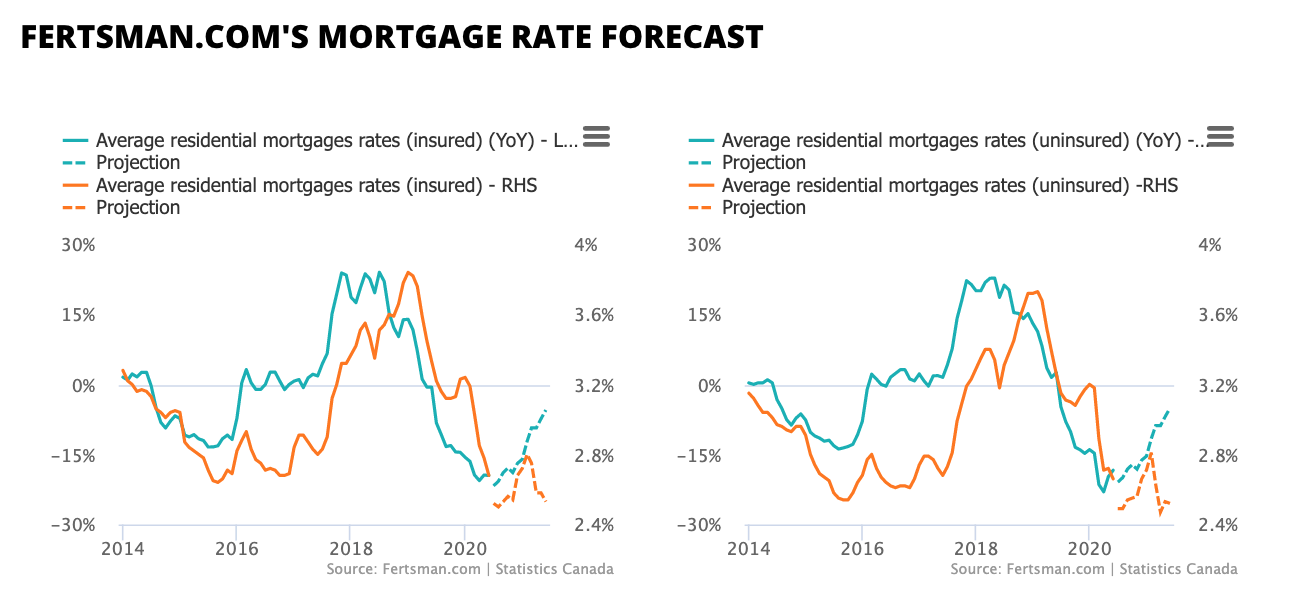

As of this month, our model suggests that average residential mortgage rates in the insured and uninsured markets likely bottomed out in August 2020 around 2.5% and that we'll probably see average rates rise marginally to around 2.8% in February 2021. Average rates will probably fluctuate between the 2.5% and 2.8% between now and June 2021. This model assumes market conditions remain the same as the previous 6 years. Where rates go from there depends a great deal on growth in the mortgage market.

If you found this article/model interesting, you may also like our home price model.

Cover image by: Alvaro Reyes via Unsplash

*The model and forecast presented in this article is for informational purposes only and does not constitute as investment advice or inform any purchase of financial products or real estate. Please consult with a registered professional before making any investment or purchasing decisions.

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.