September bank credit statistics show more mortgages, but even fewer consumer loans

The latest Canadian bank credit statistics have been released by Statistics Canada. Bank credit is an important ingredient of economic growth. Without it, there's hardly any money (deposits) being injected into the economy, and so people tend to have a harder time getting money into their bank accounts to pay for things. As a result, there are fewer transactions in the economy, and prices have a hard time growing. Governments also find that they are managing to collect fewer tax revenues.

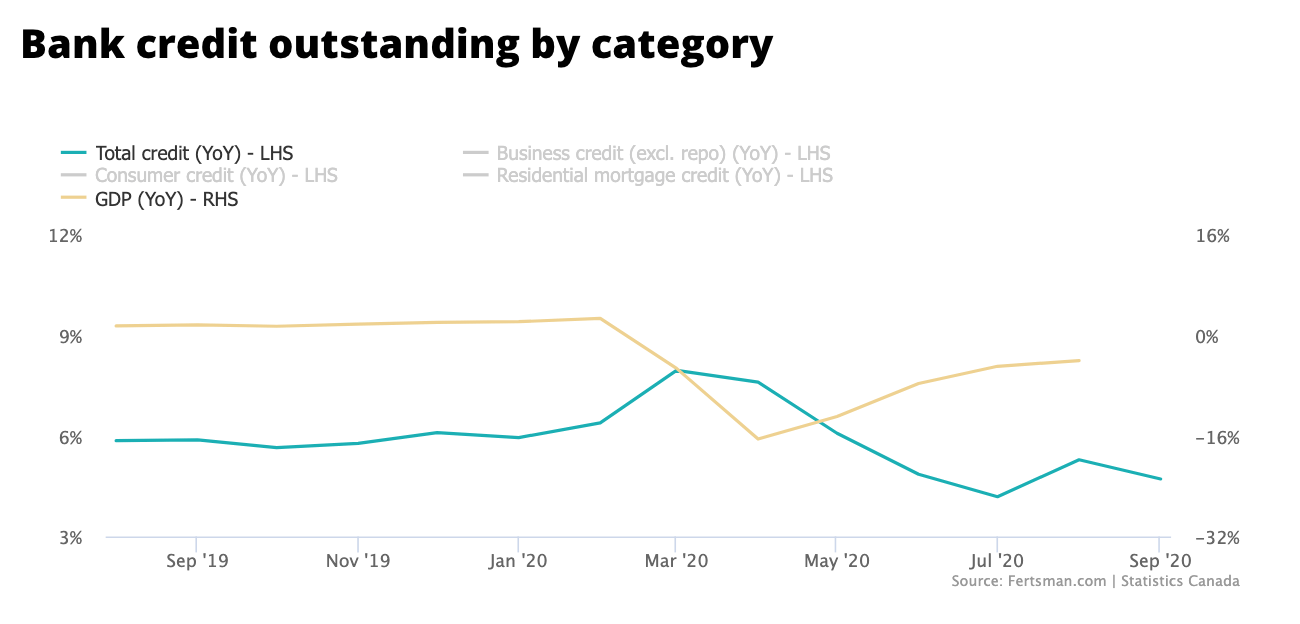

In terms of the latest numbers, the good news is that total credit levels continued to grow in September. This is despite the fact that Canada's Covid-19 epidemic curve began to break records. The bad news is that this credit growth came primarily from growth in mortgages.

Total credit levels increased 4.7% in September from the same time last year. Total credit outstanding jumped to $2.538 trillion CAD. This growth was led, unsurprisingly, by mortgages.

Outstanding mortgage credit grew by a face-numbing 7.14%, to $1.288 trillion CAD. This is a very strong performance, especially considering the size of the outstanding pile of mortgages across the country. This strong performance led to a very strong rise in the price of real estate across the country in September.

However, business loans only tallied up to $388.1 billion CAD, growing 4.36%. This is a relatively disappointing number. Usually we see growth range somewhere between 10% and 15%, but even that can be considered low. Double digit business credit growth is required to sustain growth of wages and employment across the country.

Outstanding credit levels would have grown more had it not been for the situation in consumer credit. Consumers have brought credit levels down by 2.69% in September to just over $517 billion CAD. As we've discussed, this is largely due to a collapse in credit card credit outstanding, lower levels of personal lines of credit outstanding, and weak growth in auto loans.

Overall, the September data is not encouraging and shows us that GDP figures will likely post another contraction when data for September comes out at the end of the month. Only mortgage credit grew in September, resulting in higher real estate prices. Recall that most real estate transactions don't get recorded as GDP transactions.

Cover image by: Etienne Martin

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.