Bank of Canada keeps overnight rate at 1.75 percent

July 10, 2019

Erik Fertsman

The Bank of Canada (BoC) maintains its key interest rate at 1.75 percent as it watches global trade burn, and anticipates a rate cut south of the border by the US's Federal Reserve.

- Overnight rate at 1.75 percent

- Bank rate is 2 percent

- Deposit rate is 1.5 percent

- Next rate announcement is slated for September 4

It's official! The BoC is maintaining

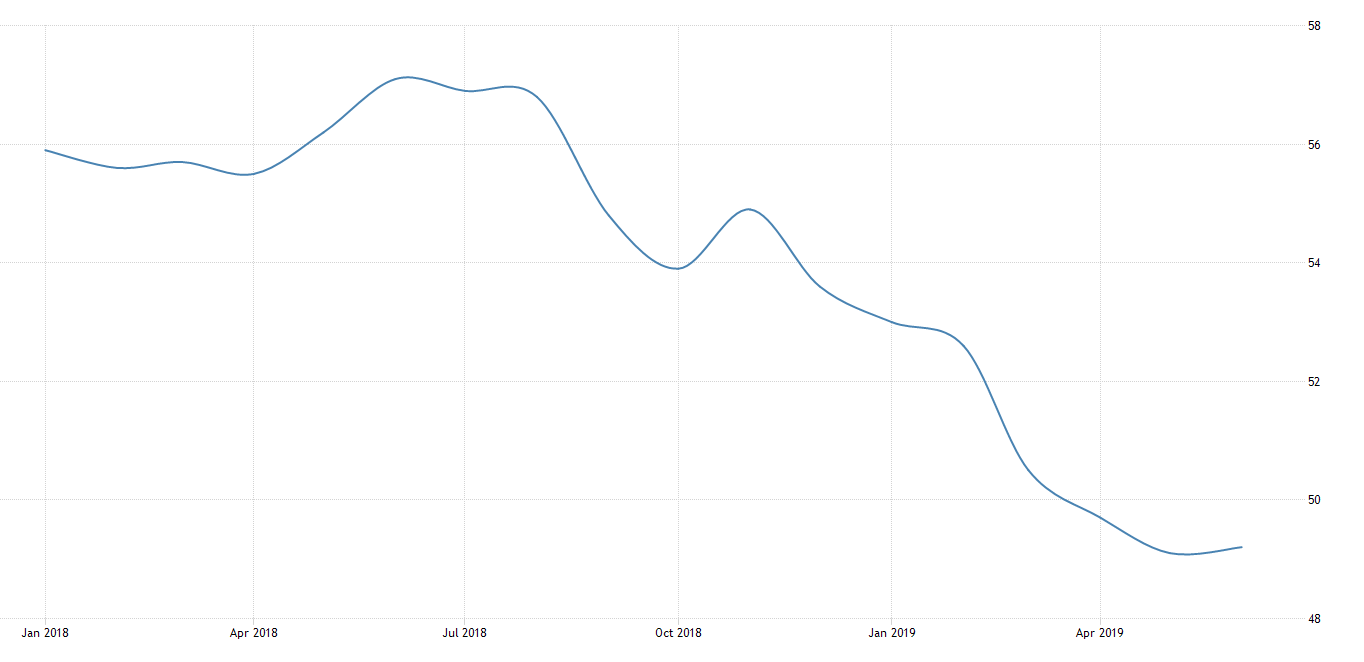

the overnight rate at the same level while it continues to stare at the data. Meanwhile, and ironically, CBC News gave coverage to the event along side its focus on the Bombardier announcement, that the company will be slashing half of its workforce in Thunder Bay. This news seems to be a surprise to people, but the data (see the chart below) has been negative for manufacturing since last year. In March this year, the Canadian manufacturing PMI entered into contraction (below 50), and the downtrend has yet to end.

While manufacturing around the country continues to slash its workforce and close-up shop, the Bank of Canada is obsessed with its inflation-targeting and stuff. Meanwhile, provincial and federal governments refuse to throw any more money at manufacturing as there seems to be no political appetite for such silly moves. Well, I guess the market will fix itself, right? A tiny interest rate cut down the road will turn everything around - don't worry!

The BoC blames the global economy

The BoC also said "policy is responding to the slowdown: central banks in the US and Europe have signalled their readiness to provide more accomodative monetary policy and further policy stimulus has been implemented in China." Yep, China is ahead of the west and will keep gaining an edge through monetary policy. Here's the thing, the People's Bank of China (PBOC) - China's central bank - doesn't use interest rates as their primarily weapon; they use credit allocation and something called "window guidance" to push out credit more strategically. This is a way more effective way of delivering stimulus to the economy. The BoC or even the Fed can't match the PBOC unless they adopt strategic credit allocation tools beyond their quantitative easing policies, which are "fail-safe" tools rather than proactive tools.

The BoC expects global GDP to grow at a 3 percent clip this year, and increase to 3.25 percent in 2020 and 2021. This will undoubtedly be revised and, at this point, the BoC has no idea, really, what will happen 6 months from now.

Forget about trade and manufacturing, everything is hunky dory at home

According to Carolyn Wilkins this afternoon, Canada is on a path to return to its growth trend! While things are doom and gloom abroad, things at home are hunky dory. According to the bank, "Canada's economy is returning to growth around potential, as expected." Indeed, GDP growth came in to beat expectations in the second quarter with surging oil production, but those expectations were too low to begin with. The bank also cites a robust labor market, so consumers are spending away! Rack-up those debts people! The BoC doesn't care about the 200-400% debt-to-income levels across the country.

They also note the housing market: "the housing market is stabilizing, although there are still significant adjustments underway in some regions. A material decline in longer-term mortgage rates is supporting housing activity." They didn't mention the problem with mortgage origination or the damage access-to-credit issues, which were generated by the new mortgage rules and stress-tests, have had on prices in the housing market. It's rates over everything.

The bank is happy because inflation is hanging around its 2 percent target, with food and auto prices increasing. They believe inflation will return to a "sustainable" level of 2 percent by next year. Here they failed to mention how inflation goals are not being propelled by domestic outcomes, but rather, they're due to currency devaluation. Hopefully Trump doesn't find out, or he'll start saying that Canada is cheating with a beggar-thy-neighbor policy. If that happens, then inflation in Canada will for sure return to its average (the line is downward-sloping, by the way).

The BoC expects domestic GDP to be 1.3 percent this year, and increasing to 2 percent in 2020 and 2021. Again, I don't think the bank has any clue what the rates will be further than 3 months out. Their forecasts are wrong every time. Until they realize that they need to pump credit into the economy (not shift interest rates around), they're unlikely to meet any

of their policy goals. While inflation is near 2 percent, it's quite simply a fluke caused by FX market speculation.

Stay tuned for the next policy decision on September 4th.

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX