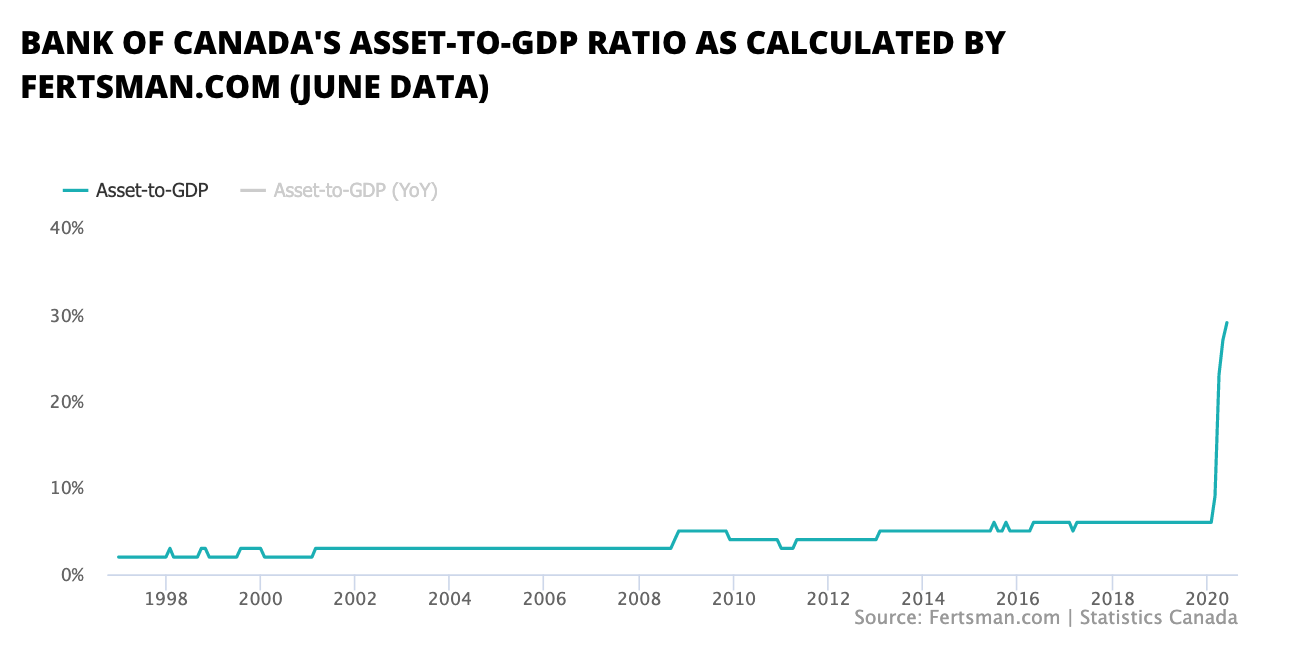

Bank of Canada's asset-to-GDP ratio up 383% so far this year

As of June, Canada's lender of last resort grew its asset-to-GDP ratio to a record 29% through its asset purchasing programs. Key assets held by the Bank of Canada (BoC) amounted to over $533 billion CAD in June, while GDP came in at $1.82 trillion CAD. On a year-over-year basis, the BoC's ratio grew by over 383% in June.

As of August, the BoC's total holdings of Government of Canada (GoC) securities are up by over 213% to a total of $338 billion CAD. In other words, the central bank is now holding over 25% of all outstanding government securities. While the total basket of GoC securities is mostly composed of longer-term bonds, the total pile of treasuries held by the BoC grew by 288% on a year-over-year basis to over $106 billion CAD. This figure is actually down by almost $25 billion CAD since June when the BoC was sitting on over $130 billion CAD worth of treasuries. Recall that total outstanding GoC treasuries amounted to $391 billion in June.

The composition of assets held by the BoC has changed slowly this year in response to certain weaknesses in Canada's financial markets. Data for August shows over $25 billion CAD worth of non-GoC assets. The central bank is sitting on $8.7 billion CAD worth of Canada mortgage bonds, $7.3 billion CAD worth of provincial money market assets, and $8.4 billion CAD worth of provincial bonds. The bottom line is that the central bank is expanding its policy scope by engaging in provincial government financing in addition to federal government and financial market financing.

The BoC also engaged in significant assets purchases through the repo market. As of August, total repo assets on the balance sheet came in at $185 billion CAD, up almost 1,600% on a year-over-year basis. As a result, total reserves at the BoC held by members of Payments Canada (i.e., banks, funds, etc.) stood at over $307 billion CAD, a 122,000% increase from a year prior. This increase is substantial due to significant liquidity demand from commercial banks who previously relied on GoC securities to satisfy liquidity requirements.

The BOC now holds over $123 billion CAD worth of GoC reserves, a 390% increase from the same time last year.

It should be noted that the BoC has not yet engaged in any asset purchases designed to assist Canada's banking sector, which holds over $2.5 trillion CAD worth of Canadian loan assets (including over $1.25 trillion CAD worth of residential mortgages). If only 5% of the banking sector's assets go bad due to a lapsing credit deferral program, it could open the door to a permanent $130 billion CAD quantitative easing program at the BoC.

We've added the BoC's asset-to-GDP data to a widget on the dashboard.

Cover image by: Jason Hafso via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.