Canadian federal government expenses skyrocket in Q2, revenue falls most in 30 years

The federal government's financial statistics for the second quarter of this year are out. The numbers show that the government's response to the pandemic is hitting the government's books hard. Expenses have skyrocketed and revenues have collapsed the most going back at least 30 years in the data. We've gone through the numbers, here's what we found.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

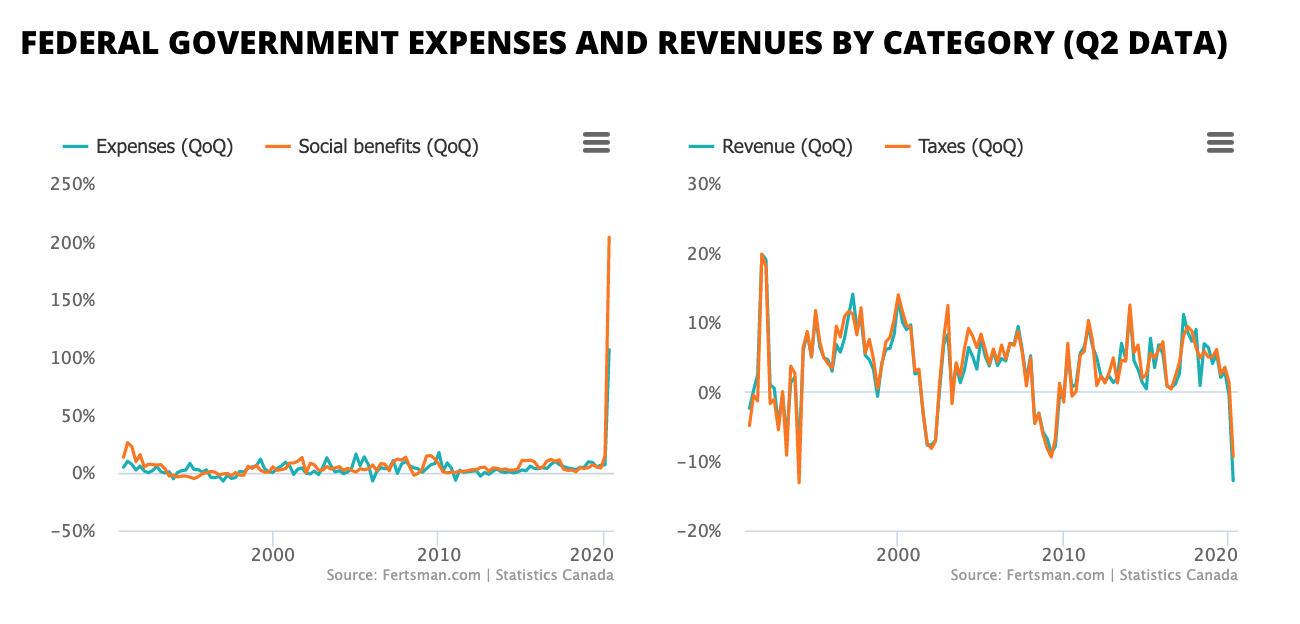

On a quarter on quarter basis, the federal government's expenses have gone up by over 100% in the second quarter. During the second quarter of 2019, expenses tallied up to just over $83 billion CAD. However, this year second quarter expenses came in at almost $173 billion CAD. It's not hard to guess where the extra spending went. It went to paying out social benefits, which cost taxpayers over $87 billion CAD in the second quarter. The figure for social benefits expenses on the government's balance sheet is up over 200% since the same quarter last year - a record breaker. Last year the government spent slightly over $28 billion CAD on social benefits.

Meanwhile, government revenues have fallen by almost 13%. It's not a disaster, but it's yet another record breaker and will significantly undermine the government's ability to spend in the coming years, not to mention balancing the books. Revenue for the second quarter came in at just $74 billion CAD, much less than what was paid out in social benefits. During this quarter last year, revenue stood at over $85 billion CAD. The fall in revenue is mainly due to a large drop in taxes collected, which fell by over 9% quarter on quarter. Total taxes collected came in at just over $65 billion CAD, down from $72 billion CAD during the second quarter 2019.

The federal government's net worth is now coming under significant pressure. During the 2008 financial crisis, revenue did fall similarly to the way it did this time around (in percentage terms), but government expenditures did not increase by any comparable margin. One of the single biggest questions now is how, exactly, does the government plan on recovering the expenses.

Will a lot of this money come back through taxation, or will those who were on the receiving end of the social benefits spend the money on repaying bank credit? If it's the latter, then a lot of the money may be destroyed and removed from circulation.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

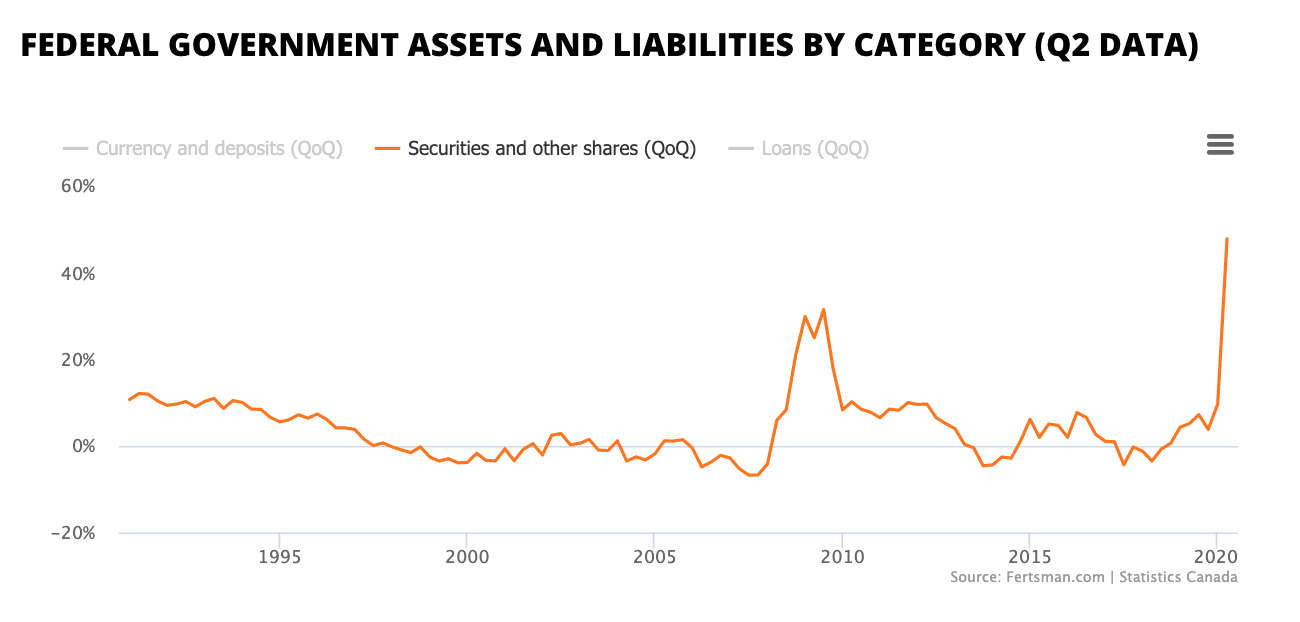

To fund the immense social expenditures, the federal government (via the Bank of Canada) has increased issuances of short and long dated securities by a record amount. Total securities and other shares outstanding on the government's balance sheet now stand at $1.16 trillion CAD, up over 47% from the second quarter of last year, which amounted to $789 billion CAD. During the 2008 financial crisis, we saw a hike in securities issuance, but this time around the issuances have been larger. Just to put things into perspective, total residential mortgage credit issued by the banks in Canada stands at just over $1.26 trillion CAD. The federal government's debt load is huge.

As a result of the record breaking securities issuances, the federal government is now sitting on a record $163 billion CAD worth of currency and deposits. The post-2008 finance crisis stockpile of currency and deposits only reached a high of $52 billion CAD.

Unfortunately, the federal government has not grown its outstanding loan balances sufficiently. Second quarter loan liabilities were up only 67% to $9 billion CAD. This can be seen as problematic given that loan growth tends to result in new deposit (money) injections into the economy, whereas security issuances generally result in the recirculation of existing deposits by the government (since most of the securities sold end up being held by non-bank purchasers). Deposit creation is a necessary requisite for growth and inflation. We'll be watching to see if the federal government decides to borrow more money from commercial banks. This would be a key component to any economic recovery plan, especially given the amount of bad debt that the banks are now sitting on.

Cover image by: Clem Sim via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.