Inflation above 2%, meeting Bank of Canada target

January 26, 2020

Erik Fertsman

In December, national inflation levels as measured by the consumer price index itched higher for the second month in a row, meeting the Bank of Canada's inflation target of 2%. The data comes in as positive news for the bank, which has struggled to keep inflation elevated since about October 2018. This has been evidence that Canada's economy is facing strong deflationary pressures, unlike the inflationary pressures of previous decades. The origin of these deflationary pressures, however, has been and continues to be a mystery to the Bank of Canada and most economists.

Article continues below.

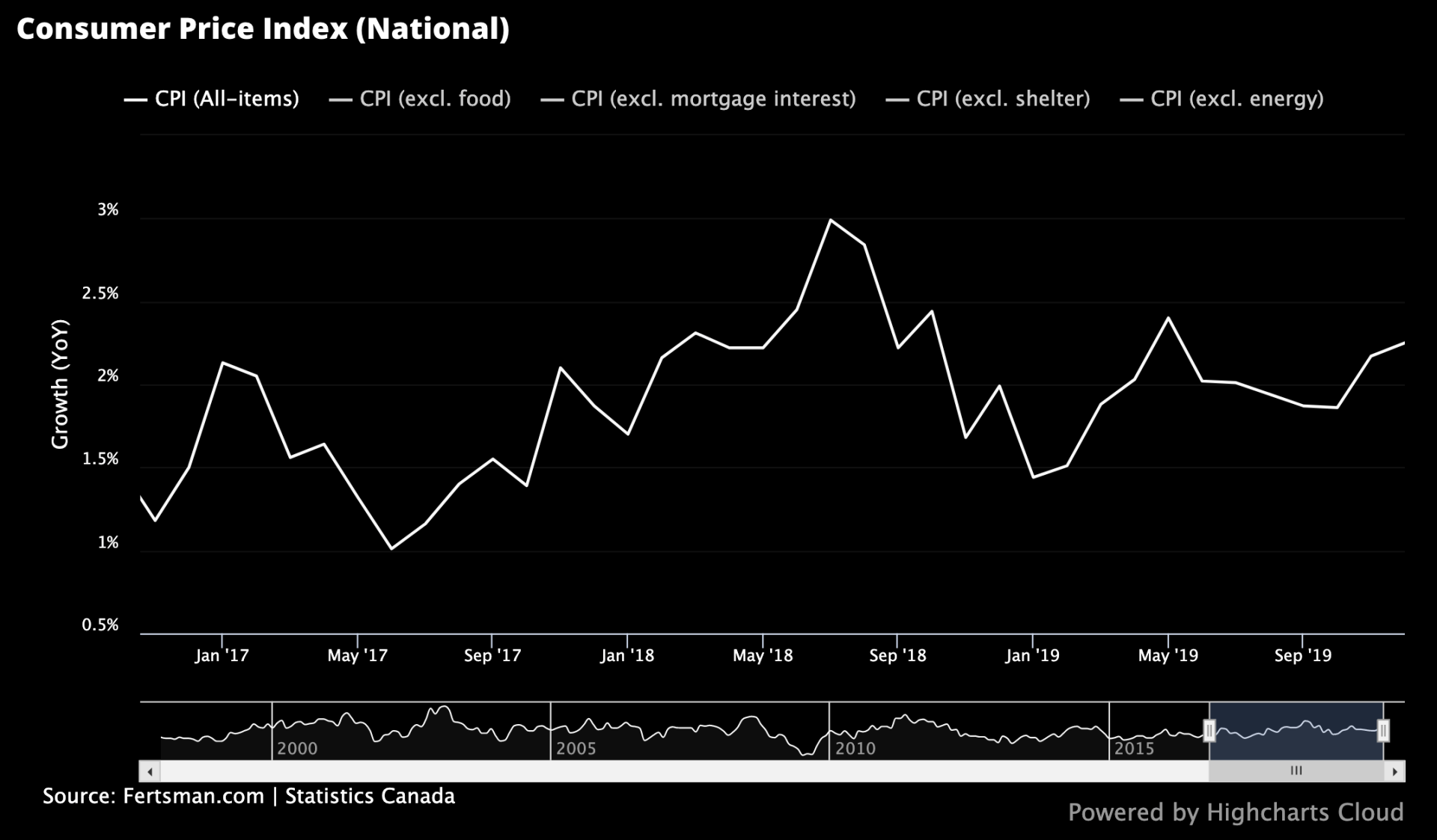

National inflation levels

On a year-over-year basis, the consumer price index (CPI) as measured by Statistics Canada is up 2.25% (see chart below). This is up from a growth rate of 2.17% in November. At the moment there are concerns that inflationary pressures will back off in the first quarter of 2020 given that economic growth has been consistently below 2% throughout 2019 and is set to trend lower in 2020.

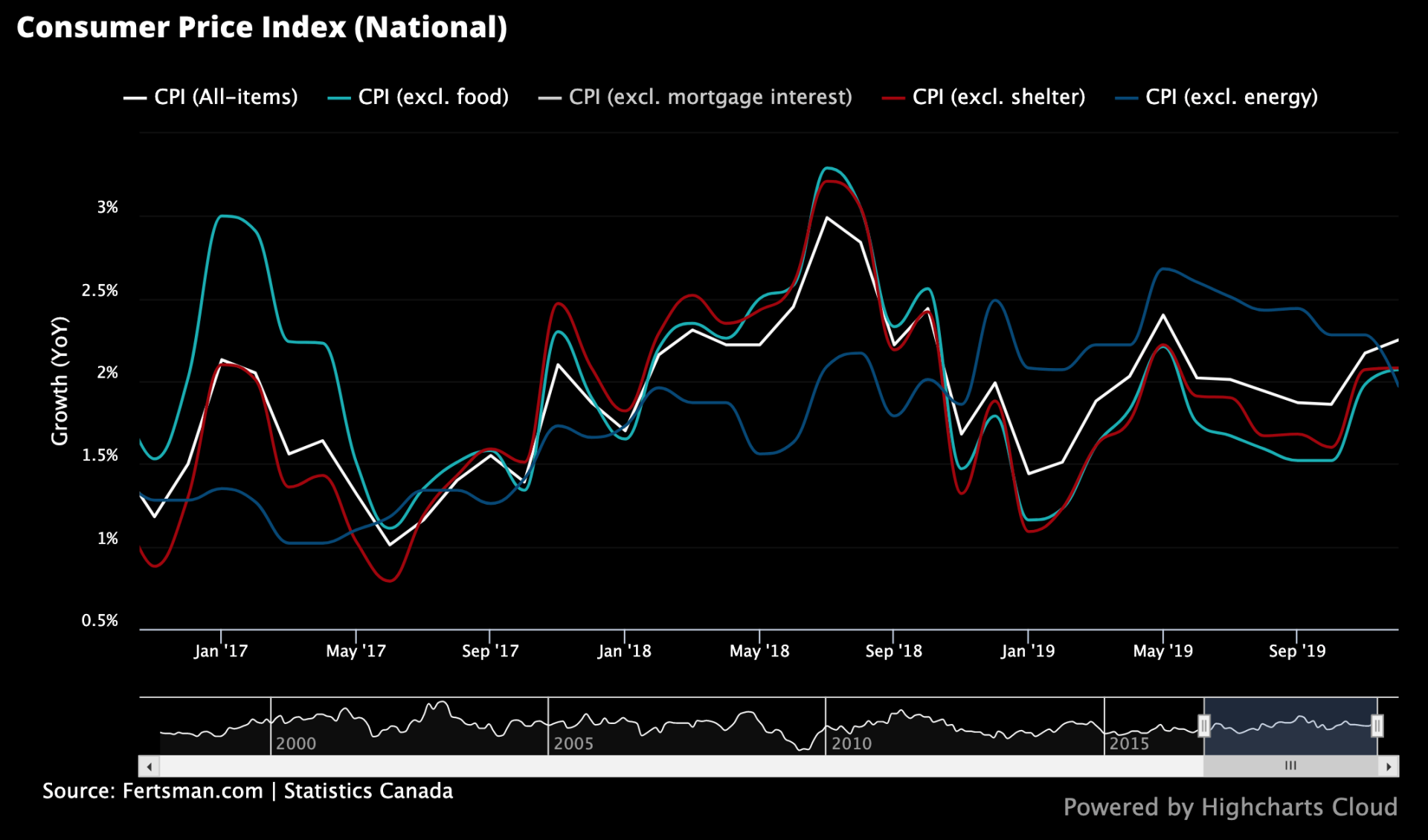

What's more, when we strip out some items such as food, shelter costs, or energy, we get different numbers (see chart below). At the moment they all come close to the 2% target. However, if we look at CPI that excludes energy costs, we can see that the growth rate is decelerating and actually now comes in below 2%. This is likely going to worry the bank. Also, CPI that excludes shelter cost (an area where bank credit-induced asset price inflation is heavy) is coming in below the overall CPI growth figure. This indicates that shelter costs are bumping up inflation figures, but this is the wrong "type" of inflation which Canadians do not need. Canada needs inflation in wages and things that will offset the damage caused by excessive inflation in financial and asset prices.

We have long maintained that deflationary pressures are largely caused by credit misallocation, or a lack of bank credit going toward the productive economy. Most bank issued credit is doled out for real estate purchases, especially for the purchase of existing homes. This money is inflationary due to the nature of bank lending. If more of this credit were to enter the economy via non-real estate sectors we believe that inflationary pressures would pickup alongside GDP growth.

Cover image by: Sebastien Cordat via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX