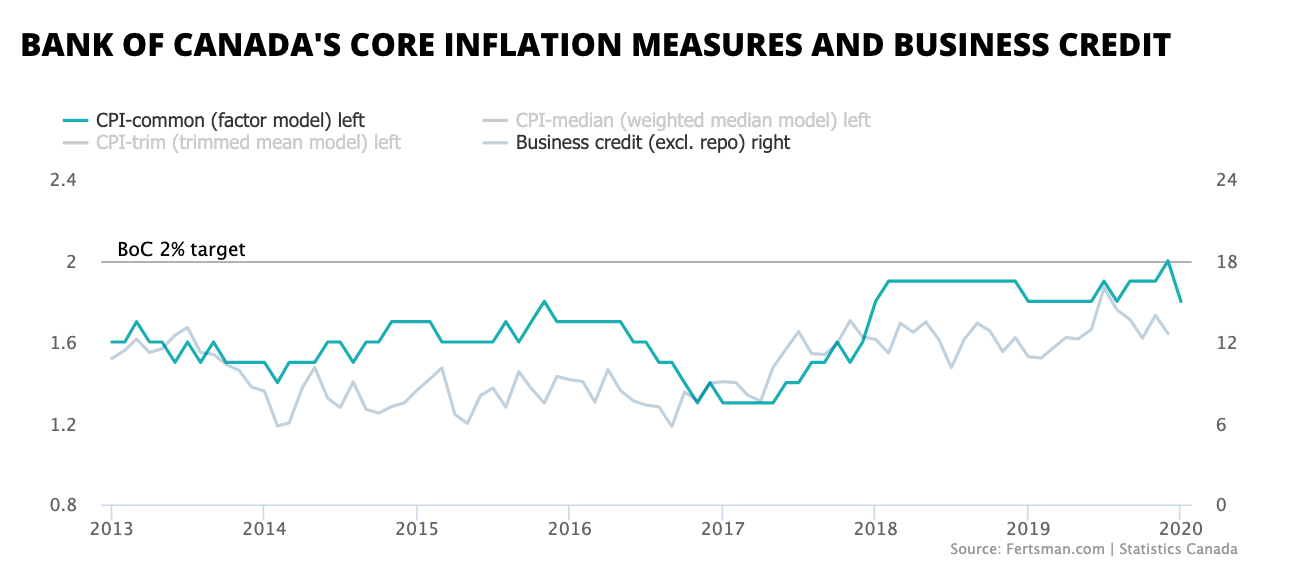

The Bank of Canada's core inflation measure drops below 2% in January

The Bank of Canada's main consumer price index measure came in below the Bank of Canada's 2 percent target in January, missing the regulator's inflation target. This measure tracks "common" price changes within the CPI basket of goods which is made up of a bunch of things Statistics Canada believes the average Canadian spends their money on.

To get the CPI-common statistic a procedure is used called "factor modeling" to detect common price variations across categories of the basket, filtering out certain price noise. The idea behind factor modeled CPI is to get a better pulse on inflation by removing volatile spikes in the overall inflation statistic. The Bank of Canada also looks at "trimmed" and median CPI statistics that remove price spikes in different ways. These indicators are currently coming in above 2%.

It should be noted that Statistics Canada reported that aggregate inflation rose by 2.4% in January. But, inflation only rose 2.0% if gasoline is excluded. Gas prices were up 11.2% on a year-over-year basis across the country. What's more, prices for fresh vegetables rose by 5% on a year-over-year basis, with tomatoes up by over 10%. The cost of passenger vehicles was also up by 2.3% when compared with prices the year before, even though overall vehicle sales fell.

The weak inflation data may lead the Bank of Canada to consider rate cuts sooner rather than later, even though a rate cut will not help the central bank achieve its inflation target or boost economic growth - only growth in bank credit that goes toward GDP will help achieve that goal. Head over to the dashboard to check out the other Bank of Canada inflation measures for January.

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.